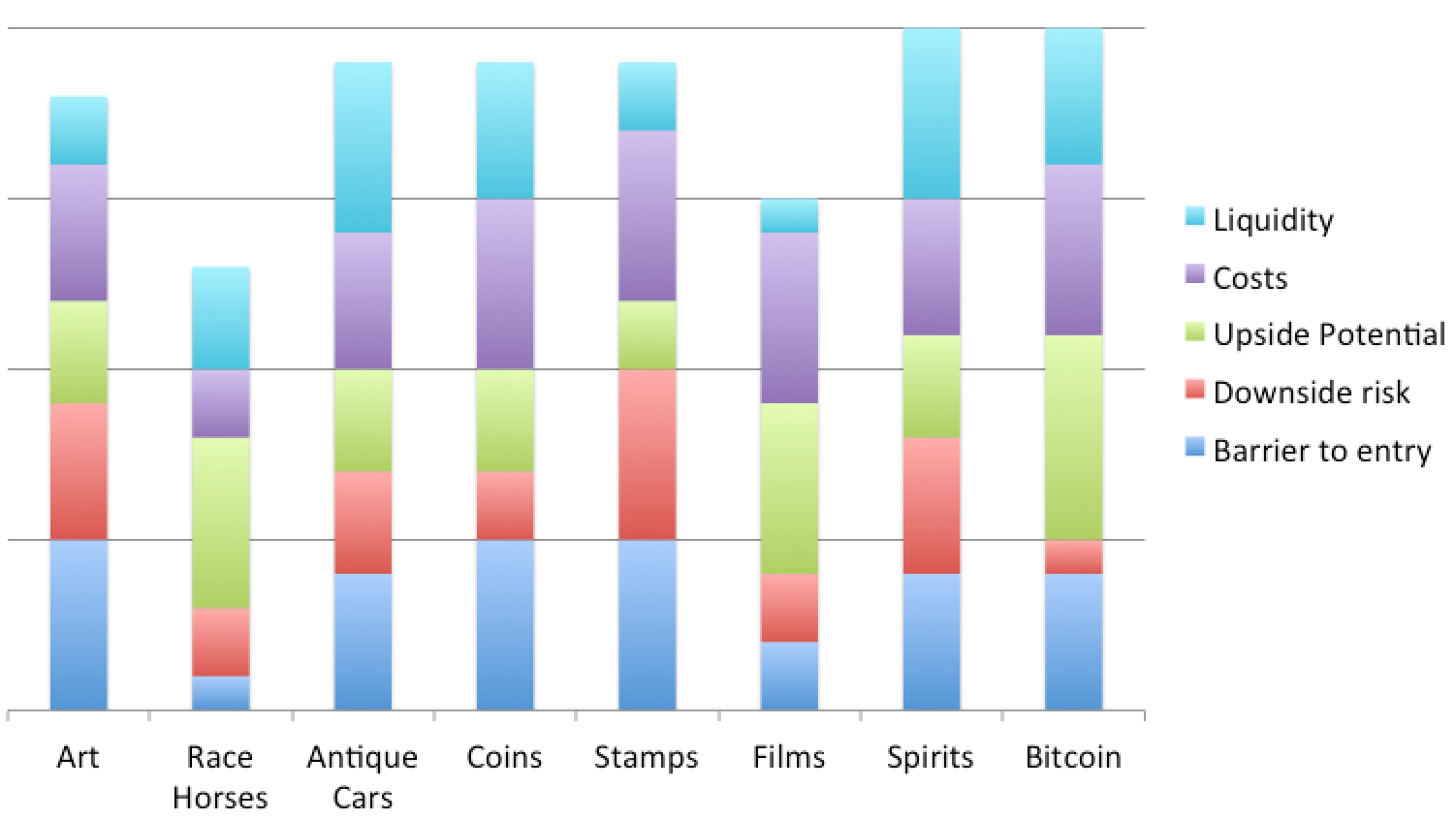

Bitcoin compared to the most exotic alternative investments

/It's a currency. It's not a currency. It's a digital commodity. It's a virtual barter token… People call Bitcoin all sorts of things. But whatever you call it, you'll agree that holding Bitcoin carries an incredibly unique risk profile, and that you should never put any money into it that you can't afford to lose - in fact, it's probably best to just mentally subtract any investment you have in Bitcoin from your portfolio.

Yet, there is a certain class of investment vehicles that specializes in uber-high risk/reward. And whether you are a cautious billionaire looking for some extra return, or a swashbuckling college student with nothing to lose, it's worth the exercise of comparing Bitcoin to other traditionally unorthodox investments.

Specifically, I would like to cover the following:

Art, Race Horses, Antique Cars, Coins, Stamps, Films, and Spirits

Along the following criteria:

Barrier to entry, Downside Risk, Upside Potential, Costs, and Liquidity

And assign the familiar A-F grading scale.

Art:

Barrier to entry: A. Luckily, all it takes to get started in art investing is buying a cheap work from your upstart painting friend. You know, the one who will be world famous in a few years.

Downside Risk: B. If the painting you purchase is of known provenance, and has documentation to back it up, and you are willing to hold on to it for a decade or more, chances are low that it will depreciate in value. Of course, painters do fall in and out of favor, so you're still rolling the dice.

Upside Potential: C. For most collectors, the process is a labor of love. Sure, from time to time you hear about a lucky son of a gun who accidentally purchases a Picasso at a garage sale for $5, and sells it for $5 million. But those examples are the exception.

Costs: B. Other than the insurance, which you should probably have, a painting just sits happily on your wall.

Liquidity: D. Unloading a painting can be a frustrating and time-consuming activity and to find a buyer for an expensive piece of art you may need to employ the expensive efforts of Sotheby's or one of its competitors.

Race Horses:

Barrier to entry: F. How many race horse owners do you know? If the answer isn't zero, you probably have a house in Monaco.

Downside Risk: D. Only one horse wins each race, and if you think betting on a loser is painful, imagine owning one.

Upside Potential: A. If you buy the right horse, hire the right jockey, and win the triple crown, you can retire your steed and have him submit to a cushy and lucrative life of breeding and collecting stud fees.

Costs: D. Boarding fees, jockey fees, vet bills, entrance fees, shoeing, transportation…

Liquidity: C. Buying and selling prized horses isn't exactly easy, but there are established avenues.

Antique Cars:

Barrier to entry: B. It won't be an expensive car. But picking up an old washed up Camaro and applying some elbow grease can get you started, even on a shoestring budget.

Downside Risk: C. You've got to do your homework. The natural progression for cars is to become worth less over time at an ever-decreasing rate. The trick is to pick up a classic car on the bottom of the depreciation curve, and put it in tip-top condition.

Upside Potential: C. Most antique car investors prefer to collect rather than to flip their beauties. But if you do decide to sell, chances are you'll break even after taking into account your maintenance costs.

Costs: B. After the initial tune-up, you have the option of garaging the car and keeping it covered as long as you wish, and even letting the insurance expire to save a few bucks in the meantime. If you intend to drive it, this will obviously drastically increase your yearly upkeep.

Liquidity: A. Thanks to the internet, buying and selling antique cars is pretty easy.

Coins:

Barrier to entry: A. Put your hand in your pocket. Do you have any coins? If yes, now you're a numismatist.

Downside Risk: D. Coin collecting is a life-long and enduring process. More often than not, you'll overpay along the way trying to complete a particular collection. When it comes time to sell, you'll probably do it wholesale, and effectively discount all of your precious treasure.

Upside Potential: C. Most valuable coins are already in the hands of collectors, so to win at this game, you'll need to try your hand at predicting the future. Which coins can I find today which will be rare and coveted in 30 years? Some can succeed at this, but most fail.

Costs: A. Just stick them in a shoebox in your closet, or a safe if they are worth something substantial.

Liquidity: B. You'll always be able to find a buyer if you're willing to sell for the face value of the coin. In a worst case scenario just spend them at your local supermarket (except for international coins, obviously).

Stamps:

Barrier to entry: A. Did you receive mail today? Congratulations, you're a philatelist!

Downside Risk: A. With stamp collecting, chances are that you've acquired your papery trophies at mostly market rates. If you paid top-dollar for a well-known or famous stamp, then you do expose yourself more substantially, but typically stamps are picked up in bulk on the cheap.

Upside Potential: D. Less and less people are trading stamps, and real "winners" are hard to come by these days.

Costs: A. Just stick them in the shoebox where you keep your coins!

Liquidity: D. Unless you are part of a stamp-trading community, it's going to take you a while to unload your stash at a price that's acceptable to you.

Films:

Barrier to entry: D. It's not hard to find independent film makers who will take your money. But to get on board with any type of significant position in a film with potential, you're going to need to be an accredited investor, and probably plop down at least six figures at a minimum.

Downside Risk: D. Films go bust all the time. And even if you succeed in completing your film, the ultimate jury is the viewership around the world. If nobody pays to see it, it's a flop.

Upside Potential: A. Most films lose money, and yet the average rate of return on film investing over the past 5 years has been about 8%. Why is that? Because the winners win big. If you invested in a movie that hits blockbuster status, it's not uncommon to see in excess of 10x your initial investment.

Costs: A. After you put your money in, assuming that you're not actively managing the project, it's just a waiting game.

Liquidity: F. Most contracts will relieve you of the right to sell your position during production. Plus, there aren't really many places to go and find buyers. In addition, if you're trying to unload equity in a movie, chances are that you expect it to fail, and you're just trying to recoup what little you can before the ax comes down.

Spirits:

Barrier to entry: B. It's not an A because technically you have to be old enough to purchase liquor.

Downside Risk: B. Even if you can't get the right price for your whiskey, you can always unlock it's true value by pouring yourself a double neat and crying into your cup.

Upside Potential: C. Some spirits do tend to get more valuable with age. So when the time comes, you should be able to get a reasonable price for your abstinence.

Costs: B. It's not hard to store liquor, but if you're going to go big, you might need a warehouse, which will cost you money.

Liquidity: A. If you can't find a friend to buy it, just call up the local fancy restaurants in your area. If your bottle has a certain prestige, they'll be happy to take it off of your hands.

As you can see, alternative investment vehicles aren't for everybody, but they can be lucrative if you are willing to lose the money you speculate with. Before bitcoin becomes a viable currency, it will be similar in this respect. For our own entertainment, let's see how Bitcoin measures up:

Bitcoin:

Barrier to entry: B. Could be an A, but today it's still hard to get ahold of Bitcoin quickly and easily. Nevertheless, anybody with determination and some tech savvy can get some.

Downside risk: F. If you don't assign a very high chance to losing all the money you've invested in Bitcoin, then you're fooling yourself.

Upside Potential: A+. What else do you know if that is up almost 100x in the last year but still has the potential to grow another 100x if it's successful?

Costs: A. Holding Bitcoin is just about as free as can be.

Liquidity: B. It's an A if you are verified on an exchange. But otherwise you still have to find somebody on localbitcoins to trade with in person.

And below, we're compiled an extremely scientific representation of our comparisons. Enjoy!